You don't have to feel anxious about managing money. Most people think that becoming financially secure takes intricate spreadsheets or hardship and deprivation, but it doesn't. With easy budget shortcuts to save more, anyone—whether you are a newcomer or just attempting to make your dollars go further—can make significant gains. By using innovative budgeting tricks and newbie-approved saving strategies, you can take back financial control, feel less stressed, and position yourself for long-term success.

This book will guide you through the top personal finance tricks and simple saving tweaks that will work for any income or lifestyle.

The term "budget" tends to evoke a sense of restraint, but in fact, a budget is simply a plan for your money. What makes budget hacks to save more powerful is that they provide you with little, achievable adjustments instead of a strict rulebook. The strategies are adaptable, simple to implement, and maintainable—meaning you're going to be more likely to follow through.

Consider them as hacks to help you grasp money without making it more complicated than it needs to be.

Putting a creative spin on budgeting can change the pain of saving money into a more enjoyable way of life. Below are some creative budgeting ideas that can help you get to your financial goals faster:

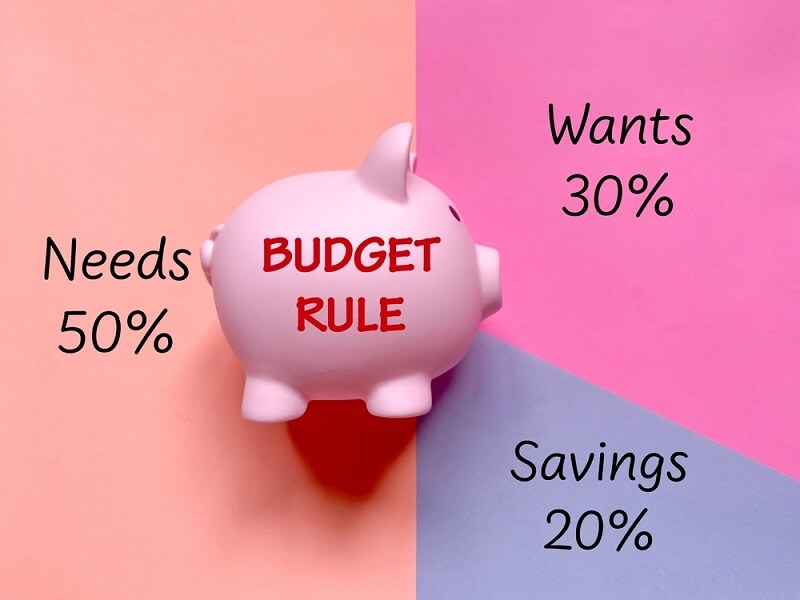

This rule typically states to spend 50% of your income on needs, 30% on wants, and 20% for savings or debt, either by budgeting or reducing expenses. A creative offset could be if you are working with a tight budget, raise savings to 30% and drop wants down to 20%. Even small adjustments make a big difference.

Spend one weekend per month on nothing except necessities. This challenge not only saves money but also breaks bad spending habits.

Each time you forgo a luxury item, such as a coffee stop, throw the money into a physical or digital jar. Seeing it grow makes the process encouraging.

Rather than budgeting how much you'll spend, set aside a certain percentage of savings first, and then live on the remaining amount. This way, saving becomes the automatic priority.

If your income is tight, saving might seem out of reach. But with some saving hints for tight budgets, you'll see openings you might otherwise miss.

Even if it's only $10 a week, pre-arranging transfers to a savings account guarantees consistency. These tiny amounts add up over time and become significant savings.

Netflix, Hulu, gym memberships – these small prices can add up fast. Reduce or suspend what you don’t use often. Reinvest that into savings.

Food is typically the largest flexible cost. Eat based on sales, buy in bulk, and prep ahead of time. You will save money and waste less food.

Don’t spend if it’s just for points, but if you use cashback rewards on staples like groceries or gas, it can return a small amount on each.

If you're just beginning with budgeting, you do not need complex methods. These simple savings methods keep it simple:

Save $500 to $1,000. This serves as a cushion. This way, you won't feel the need to resort to credit cards when unexpected bills arise.

Most apps and banks allow you to round every purchase up to the next dollar and save the difference. This makes it effortless to save up some cash.

Create a chart or tracker that shows how much you're saving toward your goals. You are more likely to be motivated by your results when you can see it!

Don't change your whole life; start with one change, like dining out only three nights a week. Once that becomes a habit, do another.

There are not always dramatic sacrifices necessary to make savings changes. Below are simple saving changes anyone can implement immediately:

These tiny, everyday decisions create long-term outcomes when done repeatedly.

While saving money is one of the many benefits of helpful personal finance hacks, the right hacks make life easier:

Don’t ever incur a late fee and set up automatic payments.

Having a travel fund, an emergency fund, or a debt repayment fund, etc., allows for easy organization.

Go over the last three months of bank statements and look for charges or patterns that went missed.

Pause 24 hours before buying something non-essential. This delay tends to avoid impulse purchases.

One hack by itself won't change your bottom line-but layering multiple strategies together can. Start small, then build on strategies:

Over time, all these steps add up to increased financial safety.

Budget hacks for saving more are potent, but there are pitfalls to dodge:

Money management, at its core, is more than dollars and cents—it's about self-assurance. When you use creative budgeting hacks and practice basic principles of saving for beginners, you create a sense of ownership and eliminate anxiety. Financial self-assurance ramps up when you see the cumulative value of your small but steady actions.

Taking back control of your finances doesn't have to be perfect. What you need is some effective, repeatable process that can be applied to everyday life. By utilizing simple budget hacks to save more, adding savings tips for a tight budget, and basically making simple changes to save more, you will shift the way you manage your money.

Start small, be consistent, and remember- how about progress, not perfection. In time, these strategies will not only increase your savings but will also give you the security and freedom that come with financial domination.

This content was created by AI