For millions of Americans, payday doesn’t bring relief—it brings pressure. Bills, lease, credit card bills, and groceries frequently drain paychecks before the month ends. If this sounds familiar, you’re not alone. The accurate information? You don’t have to stay caught in this cycle. Once you learn how to stop living paycheck to paycheck, you can take back control of your cash and create real financial freedom.

The journey starts offevolved with easy but powerful steps. Even in case you’re saving even as broke, it’s viable to build momentum and damage unfastened. By making use of financial balance recommendations, working towards living on a budget, and the usage of practical paycheck control guidelines, you may prevent feeling like cash disappears the moment it is available.

This manual will display you proven strategies to quit the cycle, keep cash, and create financial respiratory room—irrespective of your current income.

The pressure of running out of cash before the next paycheck isn’t just about finances—it’s approximately quality of life. Living paycheck to paycheck frequently leads to:

When you recognize a way to forestall dwelling paycheck to paycheck, you’re not simply improving your finances—you’re enhancing your overall well-being. The first step is breaking loose from vintage habits and building new economic techniques.

Breaking the paycheck cycle is one of the best methods to get better control over your finances. This necessitates each modification in attitude and practical moves.

Start by keeping a watch on your income and fees. Low income is regularly a hassle; however, so is unchecked consumption. Small everyday behaviors like eating out, streaming subscriptions, or impulse purchases can drain cash fast.

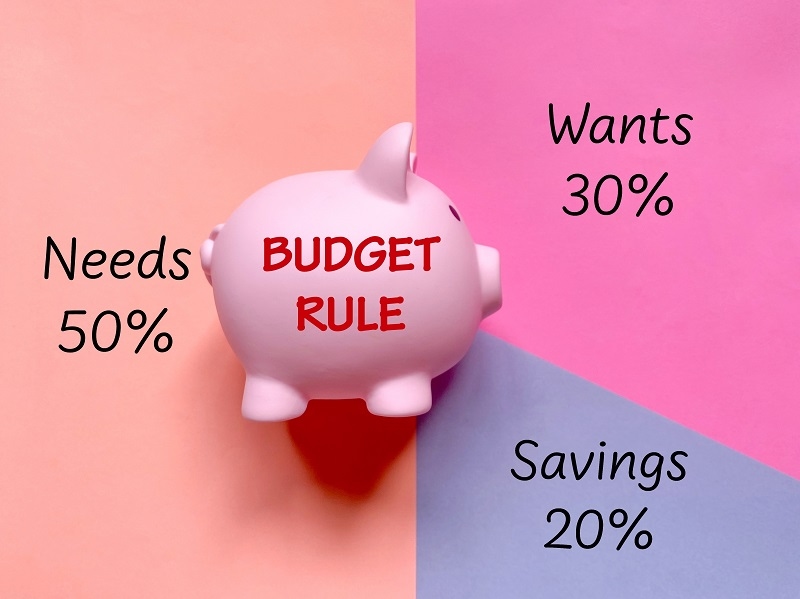

Living on a budget doesn’t suggest sacrificing pleasure—it method assigning every dollar a purpose. A 0-based finances, in which earnings minus charges equals zero, ensures you manipulate your cash rather than questioning where it went.

Even $500 can defend you from the use of credit cards for sudden expenses. This step is important in breaking the paycheck cycle because emergencies are often what push people returned into debt.

Rent, meals, utilities, and transportation need to constantly come first. Once the essentials are blanketed, you can allocate a price range towards debt compensation and savings.

By following these steps, you’ll start building momentum and weaken the grip of the paycheck-to-paycheck lifestyle.

Many human beings suppose saving is not possible whilst cash is tight. But the fact is, saving whilst broke isn't always the most effective viable—it’s essential. Here are some points to look for:

Development, no longer perfection, is the name of the game to saving even when you're broke. Saving even modest sums frequently creates a buffer that eases economic pressure.

True freedom comes from stability. Without it, every surprising rate can throw you off target. Here are some demonstrated financial balance guidelines to help you shift forward:

By building those habits, you’ll create a protection net that allows you to deal with life’s demanding situations without falling back into the paycheck cycle.

Budgeting is regularly misunderstood as restrictive; however, in truth, it offers you freedom. When you decide to live on a budget, you gain clarity and control.

The energy of living on a price range is that it makes your cash be just right for you, no longer against you.

Paydays need to be empowering, not worrying. These paycheck manipulation tips help you maximize every greenback:

By applying these paycheck control pointers, you’ll stretch your money similarly and advantage self-confidence over your budget.

Ending the paycheck-to-paycheck cycle isn’t pretty much money—it’s about attitude. Consider those shifts:

Mindset is a hidden but effective part of mastering a way to forestall dwelling paycheck to paycheck.

Once you break free from the cycle, the next step is to increase. Use your stability to build lengthy-time period wealth:

Breaking free is the best start. The remaining purpose is lasting wealth and independence.

Many people want to forestall dwelling paycheck to paycheck, but unknowingly sabotage development. Avoid these pitfalls:

By avoiding those errors and working towards economic balance suggestions, you’ll stay on course for long-term success.

Learning how to stop residing paycheck to paycheck doesn’t appear overnight—but it does appear with steady, intentional steps. By breaking the paycheck cycle, focusing on saving whilst broke, and applying economic balance pointers, you’ll create breathing room. Add in living on a budget and smart paycheck manipulation pointers, and you’ll soon note the pressure lifting.

The key is to start where you are. Even small wins—like saving your first $a hundred or paying off a small debt—add as much as a massive exchange. You don’t have to live beneath monetary stress all the time. Take management nowadays, and your future self will thank you.

This content was created by AI