Starting your financial journey may seem overwhelming, especially if you've never managed your money before. But don't panic... budgeting doesn't have to be complicated or scary! The process of budgeting is relatively simple and will give a sense of order, reduce your anxiety, and allow for a solid future. This writing will focus on five easy steps that we will pull together for budgeting tips for beginners that you can instantly apply.

This process will help you set up a simple budgeting process, using an easy paycheck budgeting workbook, to learn how to manage your money even if you don't intend to budget off an actual budget template. We will also discuss how zero-based budgeting and saving on a very tight budget can help you maximize your money. Whether you're starting your first job, recovering from spending mistakes, or just need a way to get your expenses under control, this tutorial has laid out a plan to take the mystery out of budgeting and how to apply it.

Before we discuss the steps, let us explain why budgeting is so important:

Now, let's dive into the five steps that make budgeting easy for beginners.

The starting point for budgeting is to get familiar with your money flow. You can't manage what you don't monitor.

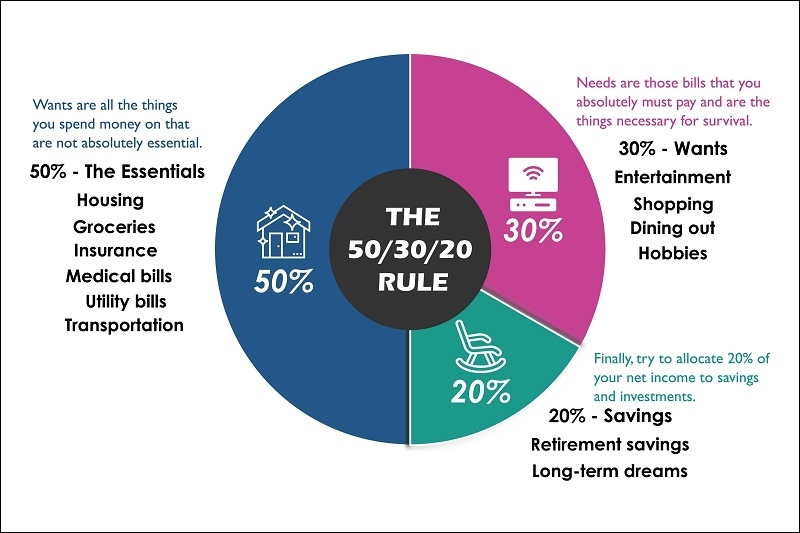

Not every budgeting strategy works for everyone. Finding something comfortable and sustainable is what is most important. Here are some simple budgeting strategies to consider:

This is beginner-friendly because it is easy to remember and easily modified.

This method requires you to assign every dollar you bring into a category, such as spending, saving, or investing, so you have accountability for it. Zero-based budgeting works very well for many people as it enables this accountability.

Allocate cash with a physical envelope or a virtual envelope to the specific categories (food, gas, eating out). When the envelope is empty, the spending in the category ends.

Pro Tip: If you're serious about creating discipline, experiment with pairing zero-based budgeting with the envelope system.

If you are living paycheck to paycheck, you will need to align your budget with your paydays. A paycheck budgeting guide helps you structure bills and expenses in order of your pay.

Example: If you get paid every two weeks, allocate the first paycheck for rent and utilities and the second for groceries, insurance, and savings deposits.

This format helps you never be short of money in the middle of the month and prevents late payments.

Saving money is a priority even when budgets are tight. The amount does not need to be large in the beginning, but saving regularly is more important than the amount. To get started saving while working with a tight budget:

Pro Tip: You can think about saving as just paying yourself first. Even if your budget is very limited, developing the habit is more important than the amount.

Budgets are not concrete—they must change as your life changes. Set aside a month's review to understand what worked and what didn't, and how you can do better.

This is a constant process where budgeting is not just a quick solution but a way of life.

It's natural to be misled at the beginning. Below are frequent budgeting mistakes to be careful about:

Having implemented these five steps repeatedly, you may be ready to refine your budgeting strategy:

The process of budgeting does not need to be daunting or seem restrictive. Following these five steps—tracking your money, utilizing easy budgeting methods, employing a paycheck budgeting worksheet, implementing a zero-based budgeting approach, and budgeting on a tight budget—will help you to develop good financial habits and experience the true meaning of success in budgeting.

As a reminder: success is all about consistency, not perfection. Budgeting is about progress, never punishment. The little, consistent changes you make as you begin to practice budgeting will result in huge changes years down the road.

If you are just learning about your money, you can start today. While it may not seem like much, begin by writing down your income and expenses. You are already taking steps towards financial control.

This content was created by AI